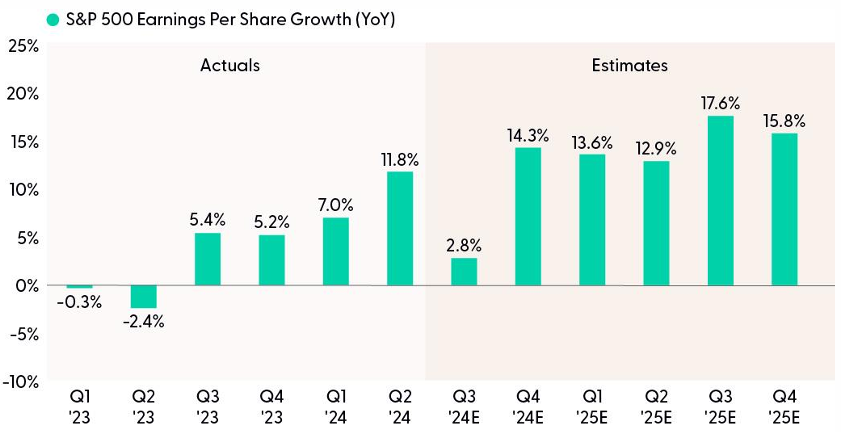

The bar for third quarter earnings is low, with analysts currently expecting only about a 3% increase in S&P 500 earnings per share (EPS). That low bar and a supportive economic environment points to potential upside. However, stocks may already be pricing in solid results, with the S&P 500 up more than 7% since the third quarter began on July 1. Here we preview earnings season and discuss some of the key drivers of earnings growth in the year ahead.

Quick Numbers Check

The S&P 500 consensus earnings growth number of 3% for the third quarter is not something to write home about, especially after double-digit earnings growth in the second quarter. The soft number is partly due to a tougher comparison. In Q2 2024, earnings had an easier comparison with a 3.3% drop in earnings in the prior-year quarter (Q2 2023 vs. Q2 2022). For the third quarter now being reported, the comparison gets tougher as earnings growth in Q3 2023 was over 5% (vs. Q2 2022).

The biggest drags on earnings this quarter are likely to come from the energy and industrials sectors, while the biggest contributions are expected to be from technology, communication services, and financials. The largest, technology-oriented companies — the so-called Magnificent Seven (Mag 7) — will again drive a big chunk of overall earnings growth even as their growth has slowed (more on that below).

Earnings Poised To Accelerate in Q4 After Q3 Slowdown

Source: LPL Research, FactSet 10/16/24

Disclosures: All Indexes are unmanaged and cannot be invested in to directly. Past performance is no guarantee of future results. Estimates may not develop as predicted and are subject to change.

We cannot come up with a good reason not to expect the typical three-point beat to earnings this quarter, especially with the banks off to a good start with an average upside surprise of over 6%. Supportive factors include:

• The economy is growing at a solid pace, driving revenue opportunities. The Atlanta Fed GDPNow forecast for the third quarter sits at 3.4%.

• Economic data has been more frequently beating expectations recently based on economic surprise indexes from both Bloomberg and Citi.

• Consumer spending continues to hold up well. Retail sales last week were the latest consumer data point to surprise to the upside.

• The services economy is as strong as it’s been all year, according to the Institute for Supply Management (ISM) Services Index, which at 54.9, is at its highest level since February 2023.

• Technology exports out of Taiwan and Korea have remained strong, which aligns with what we heard from Taiwan Semiconductor (TSM) last week as the chipmaker raised its revenue growth outlook for the year. This bodes well for technology sector earnings, the largest component of the S&P 500 by far.

Put all that together and a 6% year-over-year earnings growth number for the S&P 500, matching the average upside surprise, seems very achievable even with the drag from the energy sector (remember, energy’s loss is consumers’ gain to an extent).

Some reasons we wouldn’t expect more than the typical amount of upside include the potential for some companies to pause spending ahead of the election due to policy uncertainty, weather and labor disruptions during the quarter, and Boeing’s (BA) sizable loss.

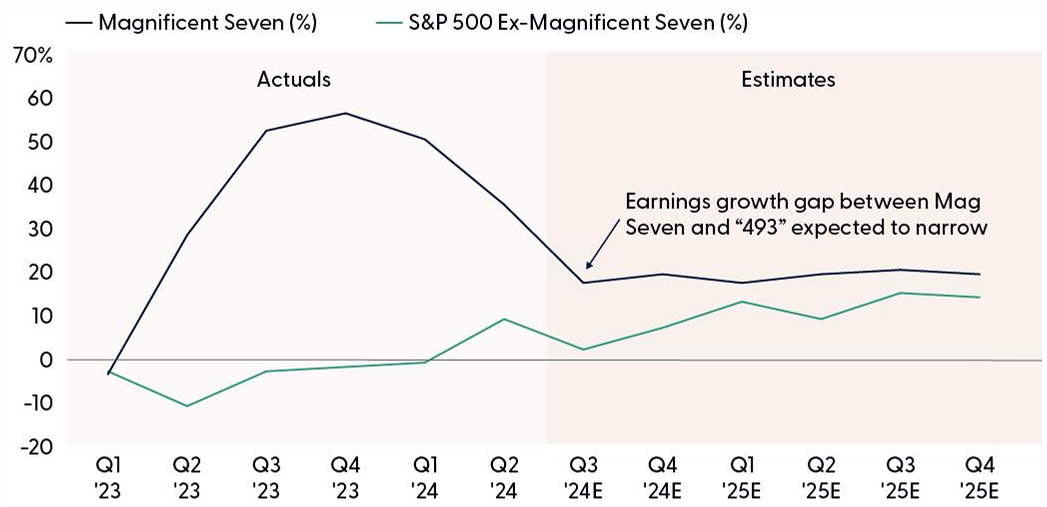

Magnificent Seven Are the Headliners

The Mag 7 is again expected to drive a significant chunk of S&P 500 EPS growth in the third quarter, although growth rates are slowing. Based on current consensus estimates, 3.3 points of S&P 500 EPS growth contribution — essentially all of it — is coming from the Mag 7. When all results are in, perhaps four out of six points will be driven by these seven companies [actually, six because Tesla (TSLA) is not expected to contribute]. NVIDIA (NVDA) by itself is expected to contribute 1.6 points of EPS growth for the index if it meets estimates calling for an 80% increase in EPS from the year-ago quarter. For a company expected to earn close to $18 billion this quarter, this growth is truly remarkable.

The downside to this tremendous growth is that when it eventually tapers off, the “493” will have to carry more weight for the S&P 500 to continue to generate EPS growth at its historical trend in the 8–10% range. For the next couple of quarters, this pace of earnings growth seems like a reasonable expectation if artificial intelligence (AI) investment continues to increasingly bear fruit as we expect. If the economy continues to grow steadily, earnings growth from the “493” should pick up and create a more sustainable foundation for this bull market. More Fed rate cuts may help.

Magnificent Seven Earnings Growth Still Leading but Gap Is Narrowing

Source: LPL Research, Bloomberg 10/17/2024

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change. Magnificent Seven includes: Alphabet (GOOG/L), Apple (AAPL), Amazon (AMZN), Meta (META), Microsoft (MSFT), NVIDIA (NVDA), Tesla (TSLA). Any company names are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

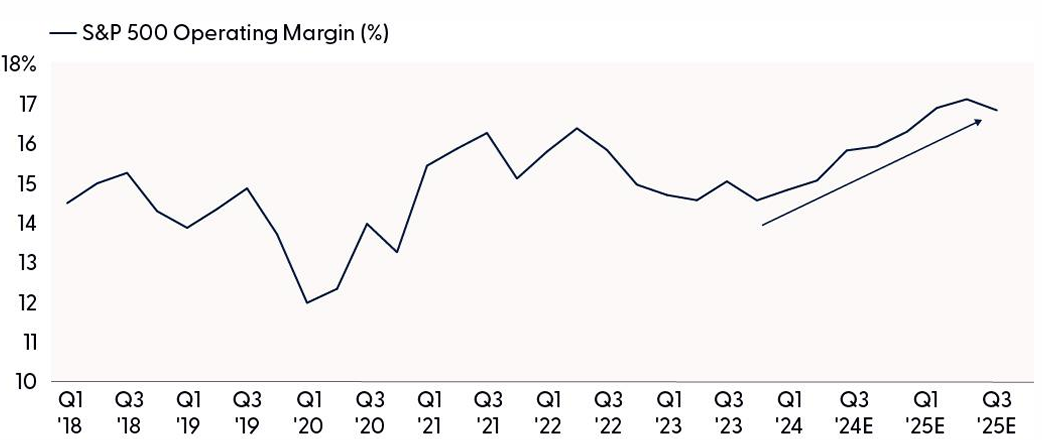

Can Margins Defy Skeptics Again?

At the most basic level, earnings represent the combination of revenue and profit margins. With revenue generally more stable and easier to predict, it’s fair to say markets react more to margins during earnings season. With margins being such an important piece of the earnings picture, we believe they are important to discuss each quarter.

Several factors beyond revenue are supportive of corporate America’s profitability this quarter and help explain why analysts are expecting the highest operating margins (15.7%) in two years.

• Supply chain pressures have mostly normalized, though the hurricane season and short-lived port workers strike put a little bit of upward pressure on costs.

• Inflation continues to edge lower. Wholesale prices are increasing at a slower rate than consumer prices, which is positive for margins all else equal.

• Interest rates have leveled off. So, although companies will still refinance debt at higher rates over time, following a decade-plus of near-zero rates, the process will be gradual and rate markets are cooperating right now.

• Energy costs are down, which certainly helps capital-intensive and transportation-oriented businesses.

• Share buybacks are on track for a record year in 2024, which will keep share counts down and boost the EPS calculation.

The upswing in margins is, of course, good news. Where we struggle is with analysts’ expectations for further improvement in margins in 2025. Estimates currently reflect another 1.3 points of operating margin expansion over the next year, which we find overly optimistic. That explains why our forecast for S&P 500 EPS in 2025 is 5% below consensus and plays into our cautious outlook for stocks through year end and into 2025.

Margins on Nice Upswing, but Expectations May Be Too High for 2025

Source: LPL Research, FactSet 10/17/2024

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

As Always, Guidance Is Key

We write this every quarter, but guidance is always critical in determining how the market will react to earnings results. The numbers for the third quarter matter, but what they mean for the fourth quarter and beyond matters more.

What’s different about this quarter is how high valuations are. At a forward price-to-earnings ratio (P/E) of 22, currently, stock valuations are near 25-year highs. So, $275 is the number to watch. That’s the consensus estimate for S&P 500 EPS in 2025. We would consider a 2% cut in estimates to around $270 to be the base case — remember, estimates almost always come down as companies report results. If estimates end up falling less than that, valuations may hold up. Of course, the election and geopolitics are big wild cards. Still, we cannot overstate the importance of the earnings outlook for stocks to maintain these elevated valuations.

Guidance Must Be Good Enough To Support Estimates Which Have Edged Lower

Source: LPL Research, FactSet, as of 10/16/24

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted.

Here are some key factors that could support earnings growth for the coming year:

• Steady but slowing economic growth, healthy U.S. consumers, and slightly above-average inflation provide a good environment for revenue growth.

• Normalized supply chains post-COVID-19 pandemic.

• Companies are controlling costs effectively and maintaining pricing power even as inflation comes down gradually.

• Investment in AI remains strong. While scrutiny on returns on those investments will increase over time, that investment is likely to boost earnings through 2025.

• It’s early, but companies may start to realize productivity enhancements from AI investments next year, supporting profit margins.

• A steeper and normal yield curve should help bank earnings.

• Fed rate cuts could help rate-sensitive businesses.

• Though hard to predict, rate cuts could weigh on the U.S. dollar, a possible boost to profits for U.S. based multinationals operating outside the U.S.

Risks to the downside include a potential slowdown in the U.S. economy; continued sluggish growth in China (even with some stimulus), and potential tariff increases post-election. In 2026, higher corporate tax rates become a risk, though that will not show up in 2025 earnings. LPL Research maintains its below-consensus S&P 500 EPS forecast for 2025 at $260, representing growth of 8%. (Our 2024 S&P 500 EPS forecast at $240 may end up a dollar or two high.)

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities. High valuations introduce risk if earnings don’t come through, but market momentum remains strong and seems to be telling us earnings will deliver. That said, the Committee acknowledges the potential for short-term weakness, especially as geopolitical threats in the Middle East escalate and the U.S. presidential election quickly approaches. Equities must also readjust to what we expect will be a slower and shallower Fed rate-cutting cycle than markets are currently pricing in, although post-election seasonality has historically been favorable for stocks.

Tactically, the Committee maintains a slight preference for growth over value; recommends keeping allocations across market caps generally in line with benchmarks; favors U.S. equities over their international and emerging markets counterparts and recommends an up-in-quality approach to fixed income, with a small allocation to preferred securities for appropriate investors due to still-attractive valuations.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

Commodities include increased risks, such as political, economic, and currency instability, and may not be suitable for all investors.

All index data from Bloomberg or FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0001985-0924W Tracking #646225 (Exp. 09/25)