The post-pandemic economy is treating people very differently, creating a headache for central bankers. The extreme differences can often get traced back to living situations, as renters have a very different experience than homeowners. Since millions of homeowners refinanced mortgages to extremely low rates a few years ago, the economy is less sensitive to interest rate policy. In fact, the Jackson Hole Economic Policy Symposium sponsored by the Kansas City Federal Reserve in August will debate the effectiveness and transmission of monetary policy because of these post-COVID-19 dynamics, likely revealing important investment implications.

LESS RATE SENSITIVITY IS GIVING THE ECONOMY A DELAYED LANDIN

One of the Federal Reserve’s (Fed) tools involves setting the federal funds rate, an interest rate that influences other market rates such as bank loans, CD rates, and mortgage rates. Typically, higher rates will slow the economy and release some of the pressure on consumer prices. But that hasn’t happened, at least not uniformly across the economy nor at the same magnitude as previous years.

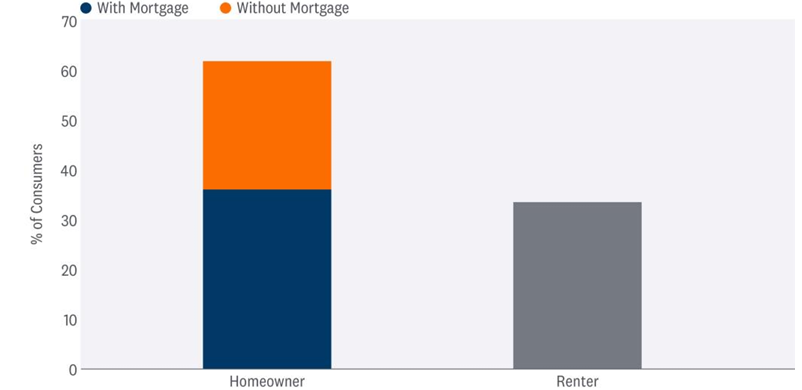

Refinancing activity provides a clue on why the economy has a delayed landing. The housing market often explains a lot about what is happening in other sectors of the economy, and this time is no different. Roughly one-third of mortgages were refinanced in the quarters following the pandemic recession of 2020, and further, a sizable number of homeowners don’t have mortgages.

LESS RATE SENSITIVE BECAUSE OF FIXED-RATE MORTGAGES

And Many Have No Mortgage

Source: LPL Research, Bureau of Labor Statistics 05/16/2024

And because of extremely low mortgage rates, these homeowners lowered their monthly payments, thereby increasing their disposable income. Other homeowners took advantage of healthy home equity and took cash out to support more spending. The incredible impact of such historic refinancing activity caught many, including us, by surprise as improved household financial conditions from low mortgage rates kept the economy out of the doldrums.

RENTERS HAVE IT ROUGH AS HOMEOWNERS FIND EXTRA CASH

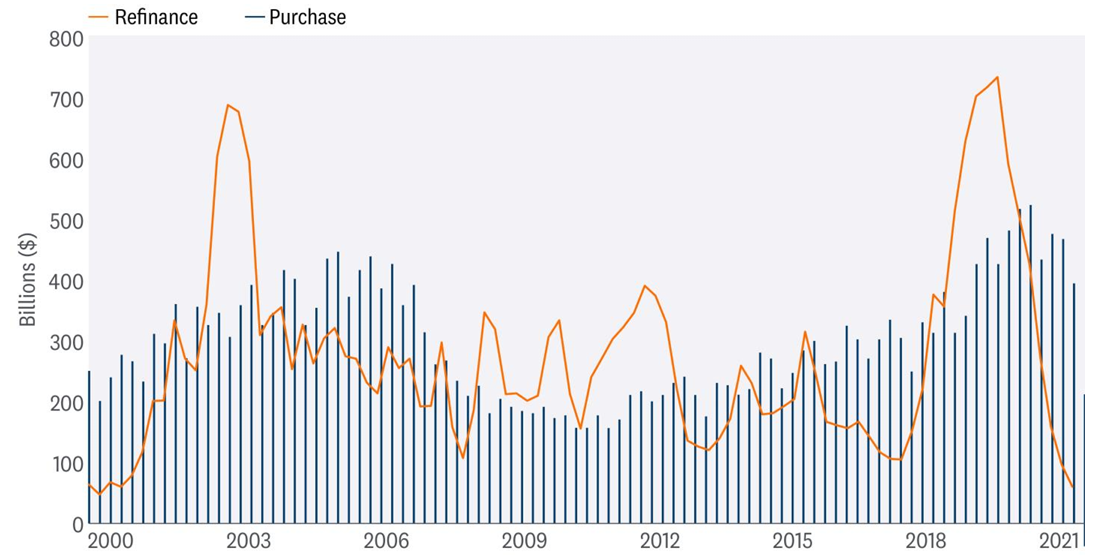

The national median asking rent was just shy of $2,000 at the end of Q1, putting immense pressure on renters as rents have increased by over 20% since the onset of the pandemic. Renters are paying roughly $370 on average more each month, a stark contrast to the savings found by homeowners who refinanced before the Fed started increasing rates. Of course, the spike in rents is more prominent in big cities such as New York City and Chicago. Conversely, those with mortgages saved approximately $220 per month on average from refinancing, and recent refinancing activity reached record levels, surpassing even those seen just before the Great Financial Crisis.

REFINANCING ACTIVITY REACHED A RECORD HIGH

Millions Lowered Monthly Payments by $220

Source: LPL Research, New York Fed Consumer Credit Panel, Equifax 05/16/24

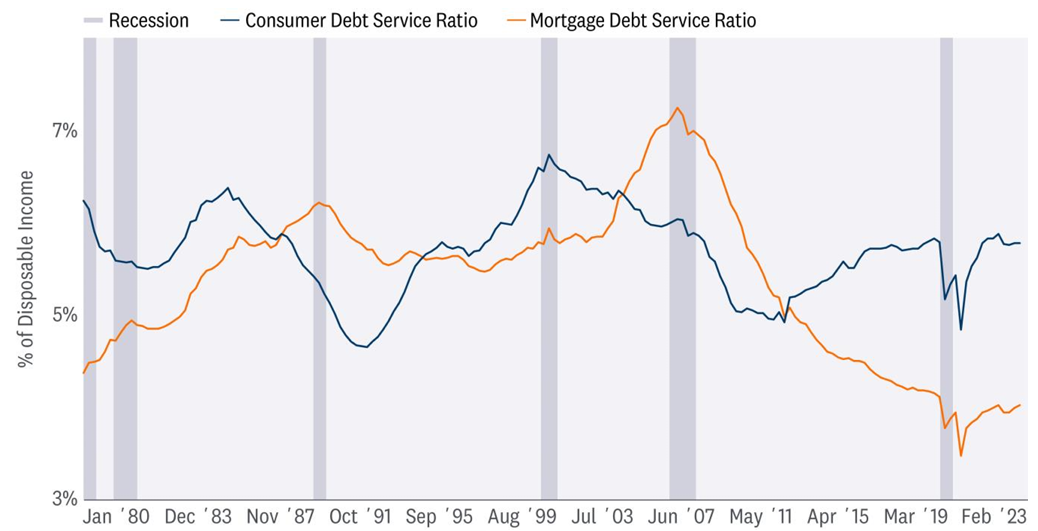

As millions of Americans took advantage of low rates, homeowners have historically low debt service payments as a percentage of their disposable income, as highlighted in the chart below. Refinancing, mostly with fixed-rate mortgages added to the spending splurge, delayed the inevitable landing, and created a headache for policy makers dealing with an economy less sensitive to interest rate policy.

REFINANCING PROVIDED A HUGE LIFT FOR HOMEOWNERS

Consumers Bonused from Lower Mortgage Payments

Source: LPL Research, Federal Reserve Board, 05/08/24

WHAT SHOULD WE LOOK FOR AT JACKSON HOLE LATER THIS SUMMER?

The Jackson Hole Economy Policy Symposium will reassess the effectiveness and overall transmission of monetary policy in a post-pandemic world. Investors and market watchers should expect Fed Chairman Jerome Powell and other leaders to talk about the challenges of monetary policy in a world less sensitive to interest rates.

OUTLOOK HINGES ON LABOR DEMAND

The domestic economy is most likely in a late cycle, and recent data suggest the consumer has started to slow down. We expect the consumer will slow spending later this year as data from both the Conference Board and the University of Michigan revealed that most consumers have pivoted away from big-ticket buying plans. These changes in buying plans could have knock-on effects in other categories of spending. Investors should anticipate a forthcoming downshift in consumer activity and its impact on discretionary spending.

The economy will likely downshift in the latter half of 2024, as consumer spending slows from the breakneck speed of 2023. The labor market has also shown signs of a shift. The quit rate fell as workers were less inclined to switch jobs, and the average workweek for private payrolls has declined, suggesting weaker labor demand. The unemployment rate will stay historically low but should inch up in the last two quarters of this year. The demand for labor is slowing, which will eventually ease inflation pressures, giving the Fed some leeway to cut rates later this year. Slower payroll growth and fewer hours worked imply the economy will slow at a measured pace, barring any exogenous shock.

TACTICAL ASSET ALLOCATION INSIGHTS

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral equities stance tactically. The STAAC recommends a neutral allocation to the consumer discretionary sector, but we are closer to a downgrade than an upgrade, and we would note that demand for big-ticket items (like autos) has come under pressure. While a strong job market and falling oil prices help, cracks in spending have begun to show, and the Committee is closely monitoring the sector.

Within equities, on a tactical basis, the STAAC continues to favor a tilt toward domestic over international equities, with a preference for Japan among developed markets, and an underweight position in emerging markets (EM).

Finally, the STAAC continues to recommend a modest overweight to fixed income, funded from cash.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

All index data from FactSet.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

RES-0001182-0424W | For Public Use | Tracking # 580471 (Exp. 05/2025)